Forget light speed; Iran went straight to ludicrous speed.

When Iranian President Hassan Rouhani took to the podium over the weekend and announced the discovery of one massive new oil field, the press ate it up.

The media was loving it.

I called bullshit.

Don’t get me wrong, dear reader. When it comes to oil, OPEC has been an absolute powerhouse for 60 years.

Five countries came together and founded the oil cartel back in September of 1960, with the sole purpose of dominating the global oil market.

Last year, the organization boasted that it held 79.4% of the world’s proven reserves.

That comes out to roughly 1.19 trillion barrels of crude!

And they’re willing to achieve that goal no matter what they have to do.

The problem is that at this point it’s hard for us to take anything OPEC says with a grain of salt, especially when the mainstream media is quick to lap it up.

You see, OPEC has a nasty little habit of not telling the truth.

Years ago, before the shale boom sent U.S. oil output soaring to new records, it was a very different environment.

OPEC members were held to a strict quota in order to — on the surface — provide stability to the oil markets.

Yet, because OPEC field data was so closely guarded, cheating on one’s quotas was not only routine — it was a running joke among analysts.

And that wasn’t the worst of their lying.

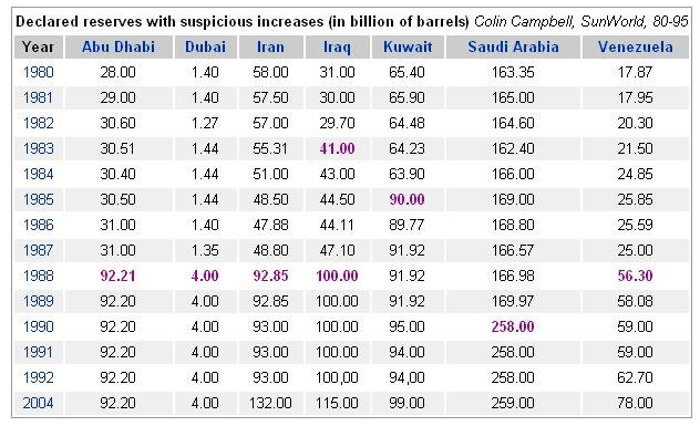

Between 1980 and 1990, seven OPEC members announced huge increases to their stated oil reserves.

Take a look for yourself:

In Iraq’s case, they doubled their oil reserves TWICE within a five-year period!

With such a wonderful track record of these kinds of shenanigans, why could today be any different?

Still, the media headlines were flooded with the news that Iran had just discovered a 53 billion-barrel oil field and that the country just boosted its 150 billion barrels of proven reserves by one-third.

Incredible!

And just to rub it in President Trump’s face a little, this was how Iranian President Rouhani announced it:

I am telling the White House that in the days when you sanctioned the sale of Iranian oil and pressured our nation, the country’s dear workers and engineers were able to discover 53 billion barrels of oil in a big field.

Even with OPEC’s shady dealings in the past, the media should shoulder some of the blame on this one.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

For one, their frenzy to stir up clicks over the Trump vs. Iran narrative might’ve blinded them to this incredulous claim.

In fact, this discovery was so outrageous that it was impossible to keep the lie going for very long.

Within a day of the announcement, Iran’s oil minister backtracked President Rouhani’s announcement, saying that it only added 22.2 billion barrels of oil to Iran’s crude reserves.

Unfortunately, the situation is even worse for them.

If one thing holds true, it’s that the oil you have in the ground is useless unless you can get it out.

Just ask Venezuela how much those 302 billion barrels of poor-quality reserves are right now, considering PDVSA appears to have no chance of ever extracting them.

According to Iran’s oil minister, only 2.2 billion barrels of that oil can be extracted with current technology.

Whomp, whomp.

Next week, I’m going to show you what a real oil discovery looks like.

This one isn’t just some work of fiction, and it’s sparked one of the quietest oil booms here in the United States.

And it’s taking place somewhere you’d least expect.

Stay tuned.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.